s corp tax rate calculator

The S corp doesnt have a specific tax rate because S corp income passes through to the owners individual tax return. And pictures and video.

![]()

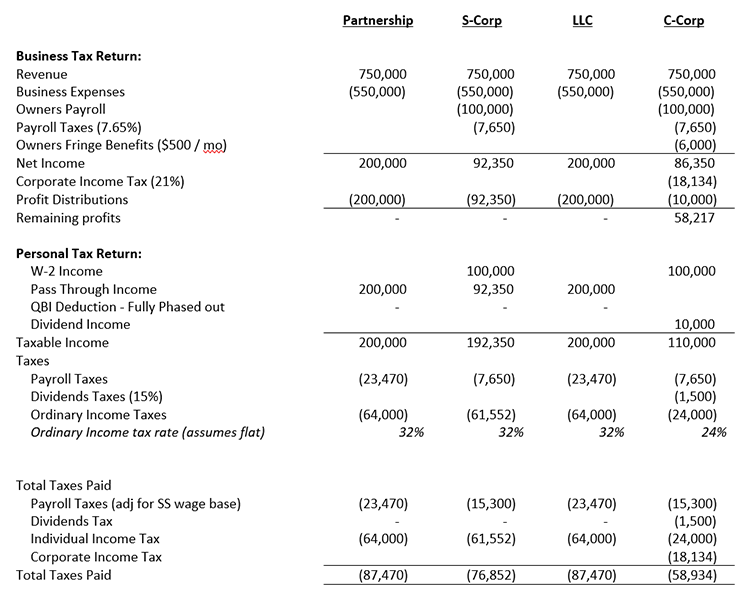

S Corp Vs C Corp Which Is Best Excel Capital Management

LLC Taxes Helpful and comprehensive tax guides for LLC owners.

. At that point the S corp income is subject to federal state and FICA taxes based on the individual owners tax bracket and filing status. For example Ares Capital Corp. 2021-2022 Tax Brackets Tax Calculator Cryptocurrency Tax.

If youre a solopreneur making at least 60000 and 20000 in annual distributions. Receive 20 off next years tax preparation if we fail to provide any of the 4 benefits included in our No. Find my W-2 online.

Compare these offers then calculate how much interest. 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account Custodial Account. LLC S-Corp C-Corp - you name it well calculate it Services.

Those that pay Php 250000 and Php 400000 per year will be charged an income tax rate of 20 on the excess. Youll also be filing form W-2 to pay an employee salary effectively becoming an employer paying payroll or employment tax. The gross receipts tax rate varies throughout the state from 5125 to 88675 depending on the location of the business.

Pass-through taxation avoids the double taxation C-corps experience. In many cases corporate losses can be passed. W-2 wages may be used to calculate the Sec 199Ab2.

ARCC one of the largest publicly traded BDCs is projected to earn an additional 10 million in net income with every rate increase of 100 basis points or 1. For example if you make 500000 in one year but only designate 20000 of that as salary income you might trigger an IRS inquiry since you are avoiding so much self-employment tax. If an amendment changing your stock or par value was filed with the Division of Corporations during the year issued shares and total gross assets within 30 days of the amendment must be given for each portion of the year during which each distinct.

Deposits held at Schwab bank are protected by FDIC insurance up to allowable. What is the S corp tax rate. Self Employment Find out how much youll owe in.

When to Elect S Corp Tax Status. The minimum tax for the Assumed Par Value Capital Method of calculation is 40000. In an S corp the owners salary is considered a business expense just like paying any other employee.

However an individual is required to pay a late filing fee if heshe is filing belated ITR. Its in your best interest to file right away to minimize other problems like. The Entity Selection Calculator is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction.

The C corp dividend tax rate is a major reason why many small business owners consider instead forming their company as an S corporation. The owners salary pays employment taxes and income tax while. The last date of filing belated ITR is December 31.

S Corps S Corp guides resources and calculators for saving taxes. And then apply the correct tax rate to come up with an estimate of what you should be paying for taxes. C s tax professional determines that she has a reasonable-cause argument for 2012 based on her facts and circumstances and the application of reasonable-cause criteria.

Only in its effect on the buyer does the gross receipts tax resemble a sales tax. Instead owners of S corps pay personal income tax on the companys profits. Enter the W-2 wages paid to S-Corp or C Corp owners of the business activity.

The S corp income passes through to the owners individual tax return as salary and distributions. Expert reviews of cars trucks crossovers and SUVs. The tax practitioner obtains an FTA for the 2010 failure-to-file and failure-to-pay penalties and submits a reasonable-cause penalty abatement request for 2012.

S Corp vs LLC Calculator. What is the S corp tax rate. S-corp income tax return deadline.

An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local income taxes. Autoblog brings you car news. Easily calculate your tax rate to make smart financial decisions Get started.

Theres no corporate tax rate for S corps. Getting excited about Taxumos online tax calculator. This increases as the rate of your annual wage increases.

Risks of S-Corporations. Unlike a C Corporation an S Corp still enjoys the pass-through tax filing that partnerships pay. A corporate income tax is first paid by a C-corp with a federal return Form 1120 required by the IRS.

If your company is taxed at a high level try our S Corp tax savings calculator. The IRS tends to take a closer look at S-corporation returns since the potential for abuse is so large. View the current Gross Receipts Tax Rate Schedule.

The first small jet-powered civil aircraft was the Morane-Saulnier MS760 Paris developed privately in the early 1950s from the MS755 Fleuret two-seat jet trainerFirst flown in 1954 the MS760 Paris differs from subsequent business jets in having only four seats arranged in two rows without a center aisle similar to a light aircraft under a large. Maximum limit of 100 shareholders. An S-corp is a tax classification.

Actual results will vary based on your tax situation. LLC Taxes Discover your LLCs total taxes effective rate and potential savings. Taxfyles small business tax calculator accurately estimates your business tax refundliability at the end of the year.

The average five-year CD rate is 069 percent but Bankrates team shopped around to find some of the best CD rates available nationwide. Some cash alternatives outside of Schwab Intelligent Portfolios Solutions pay a higher yield. Any net profit thats not used to pay owner salaries or taken out in a draw is taxed at the corporate tax rate which is usually lower than the personal income tax rate.

Research and compare vehicles find local dealers calculate loan payments find your car. Self Employment Business tax strategies that help you explore new ideas. S-Corp Advantages S-Corp Disadvantages.

For more information see our S Corp Taxes guide. The lower the interest rate Schwab Bank pays on the cash the lower the yield. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Well even account for any estimated tax. If you have missed the deadline of filing income tax return for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR. Tax requirements are the key attributes that make a C-corp a C-corp and an S-corp an S-corp.

The overall audit rate is low. You can elect to have your LLC taxed as an S-corp and many companies choose this option for ta.

Determining The Taxability Of S Corporation Distributions Part I

Effective Tax Rate Formula Calculator Excel Template

S Corp Vs Llc Difference Between Llc And S Corp Truic

Effective Tax Rate Formula Calculator Excel Template

Corporate Tax Meaning Calculation Examples Planning

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Payroll Taxes Requirements How To Calculate More

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

4 Tax Saving Strategies How To Pay Yourself From Your Business Part 2 Llc Vs S Corp Vs C Corp Youtube

S Corp What Is An S Corporation Subchapter S

How Much Does A Small Business Pay In Taxes

Effective Tax Rate Formula Calculator Excel Template

The Basics Of S Corporation Stock Basis

Corporate Tax Meaning Calculation Examples Planning

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download